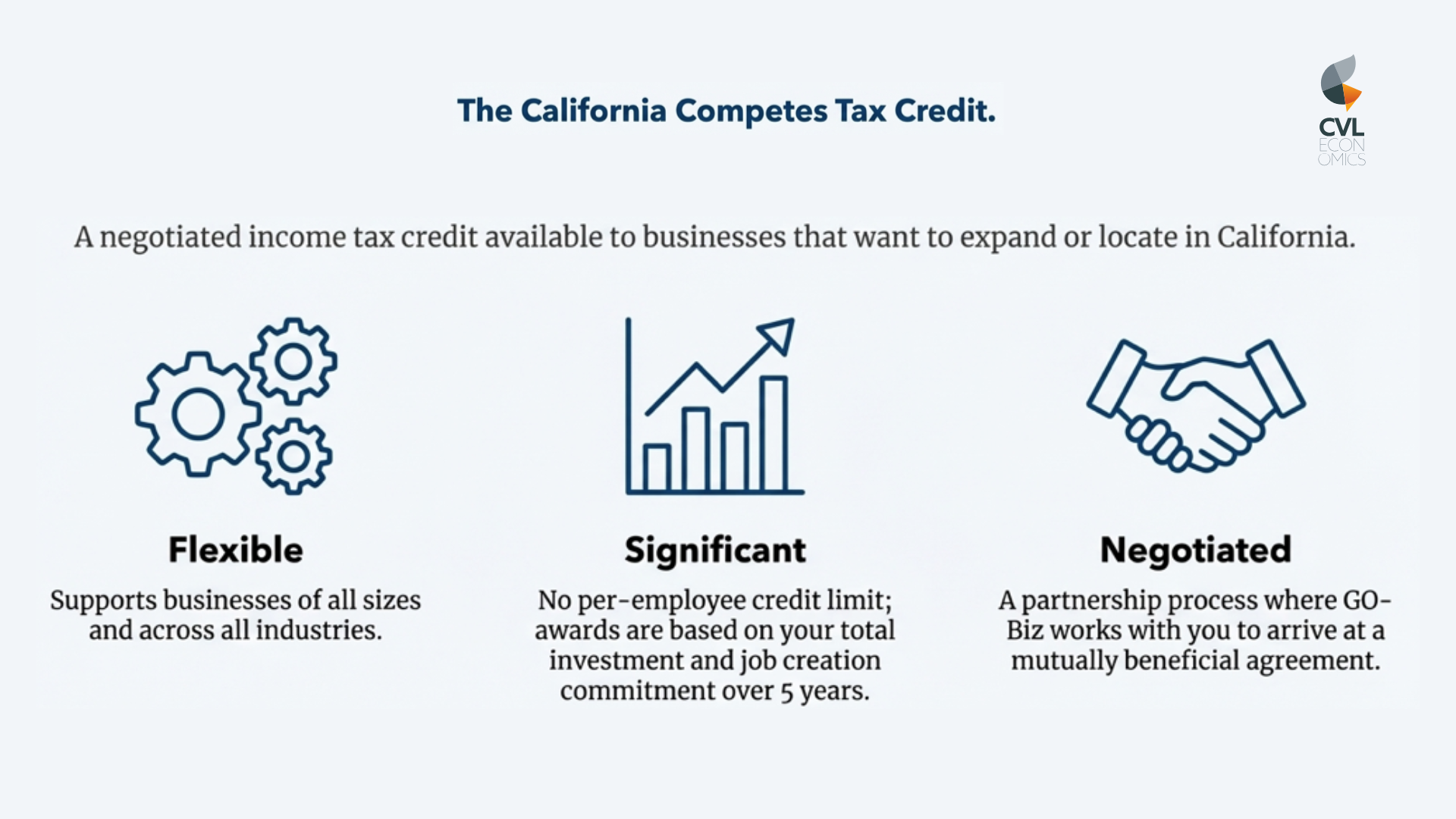

California's creative economy, from film production and video game development to digital media, music, design, and live entertainment, now has a direct pathway to significant state investment. The California Competes Tax Credit (CCTC) program is giving special consideration to industries that the state's Jobs First initiative has designated as "strengthen" sectors. For Fiscal Year 2025-2026, the creative economy has earned that classification, placing creative, entertainment, and media businesses among the state's priority targets for a share of $308 million in available tax credits.

For creative economy businesses evaluating expansion, workforce growth, or capital investment decisions, this designation marks a notable shift in how California prioritizes industries competing for limited incentive dollars. The Governor's Office of Business and Economic Development (GO-Biz) is sending a direct signal: the state wants creative economy companies to grow here, not elsewhere.

Why the "Strengthen" Designation Matters

The CCTC program evaluates applications through a competitive, two-phase process that weighs both quantitative metrics and strategic alignment with state priorities. The Jobs First framework classifies "accelerate" sectors as industries with moderate to high projected growth that are poised for expansion. "Strengthen" sectors are those where California has an established competitive position and significant employment, but where growth or wages have plateaued. GO-Biz believes targeted investment in these industries can 'bend the curve' to generate outsized economic returns. By aligning CCTC evaluation criteria with Jobs First priorities, the state has created a through-line from economic development strategy to business incentives.

California already accounts for one in every four creative jobs nationally. The entertainment industry generates billions in economic activity, supports extensive supply chains, and drives tourism, real estate development, and ancillary business growth. Yet competition from states like Georgia, New York, and New Mexico, each armed with aggressive incentive programs, has intensified pressure on California to retain and grow its creative sector business ecosystem.

The creative economy's "strengthen" designation reflects California's strategic response. Creative businesses applying for tax credits now enter the evaluation process with built-in advantage: their industry's growth trajectory and economic multiplier effects are already recognized as state priorities.

Who Should Apply

The creative economy includes a broader range of businesses than many assume. Historic CCTC awards in this sector have gone to film, television, and video production companies; digital media and animation studios; music rights services and sound recording businesses; graphic design firms; architecture practices; publishing houses; video game developers; and design education institutions.

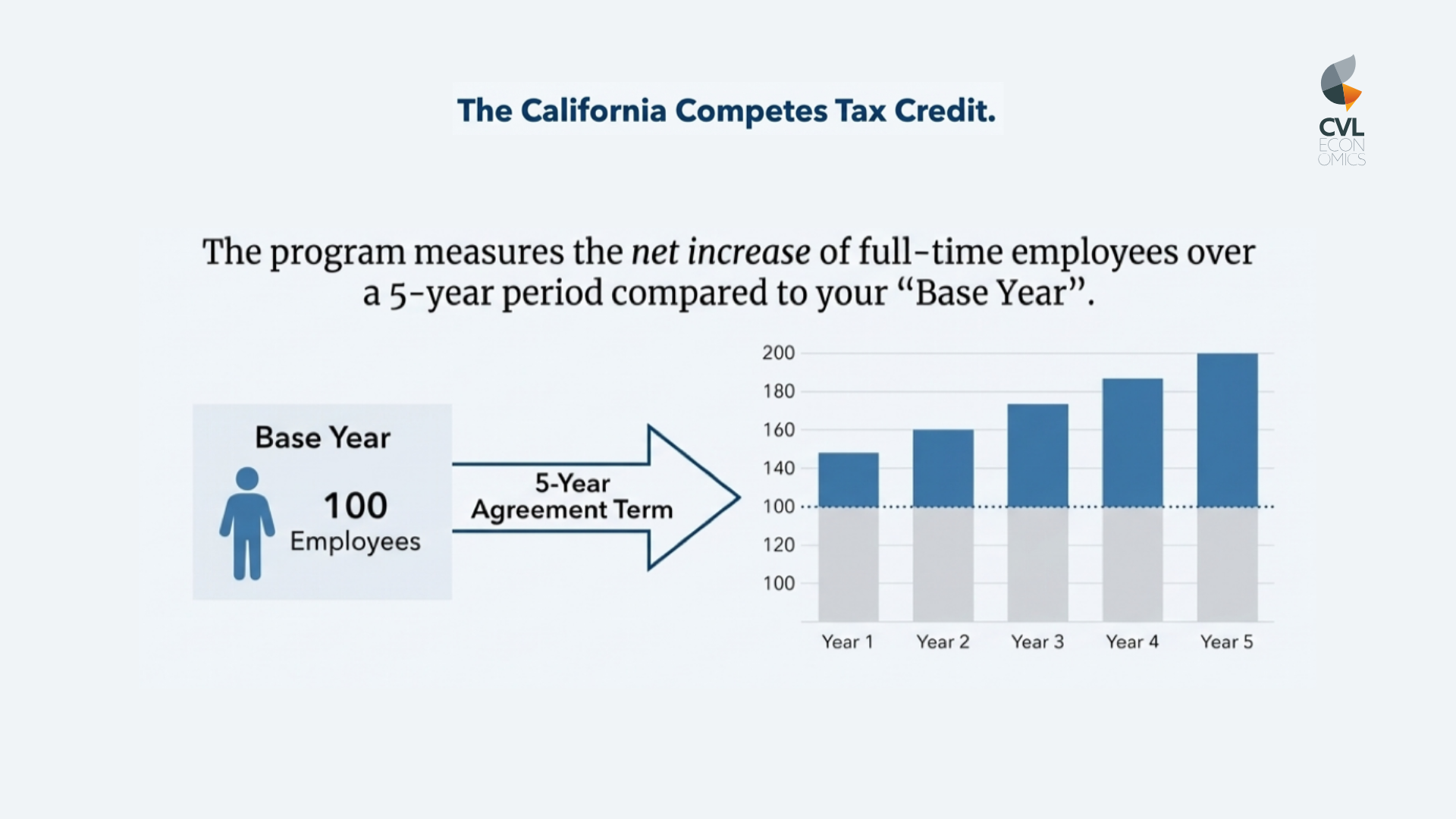

Eligible applicants must demonstrate that the tax credit is a "material factor" in their decision to create new full-time jobs in California. This is the program's central requirement, and it demands a compelling narrative. Companies should articulate how the credit will enable hiring that might otherwise occur in competing states, how their business competes for global market share against out-of-state entities, and what specific expansion or location decisions hinge on receiving the incentive.

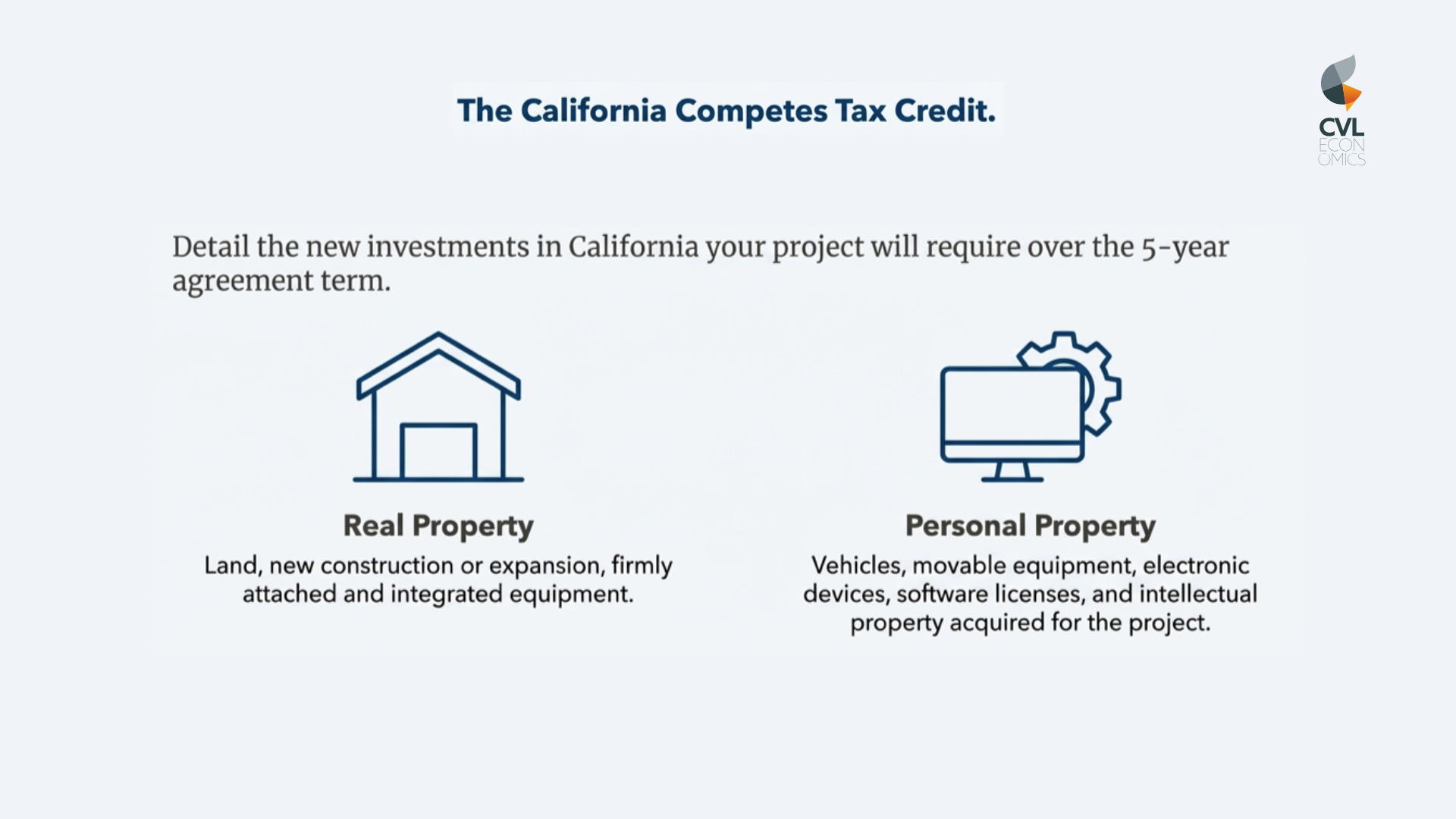

Creative businesses often hold natural advantages in the CCTC's quantitative evaluation. The program's Phase I ranking calculates a cost-benefit ratio based on the credit requested relative to aggregate employee compensation and capital investment. Because creative industries typically offer higher-than-average salaries, particularly in technology-intensive production, post-production, and software development roles, these businesses frequently generate favorable ratios that advance them to Phase II consideration.

Strategic Pathways and Equity Considerations

The CCTC also provides alternative pathways for applicants who can certify that their project would otherwise occur in another state or that at least 75% of new hires will work in designated high-unemployment or high-poverty areas. Qualifying regions include cities like Fresno, San Bernardino, Long Beach, and various rural communities throughout California. For creative businesses with flexibility in where they locate production facilities, post-production houses, or regional offices, these provisions create additional competitive leverage.

This intersection of economic development incentives and geographic equity reflects an important evolution in how California approaches business retention. Creative businesses that align expansion plans with underserved communities strengthen their applications while contributing to more equitable economic growth across the state.

Application Timeline and Next Steps

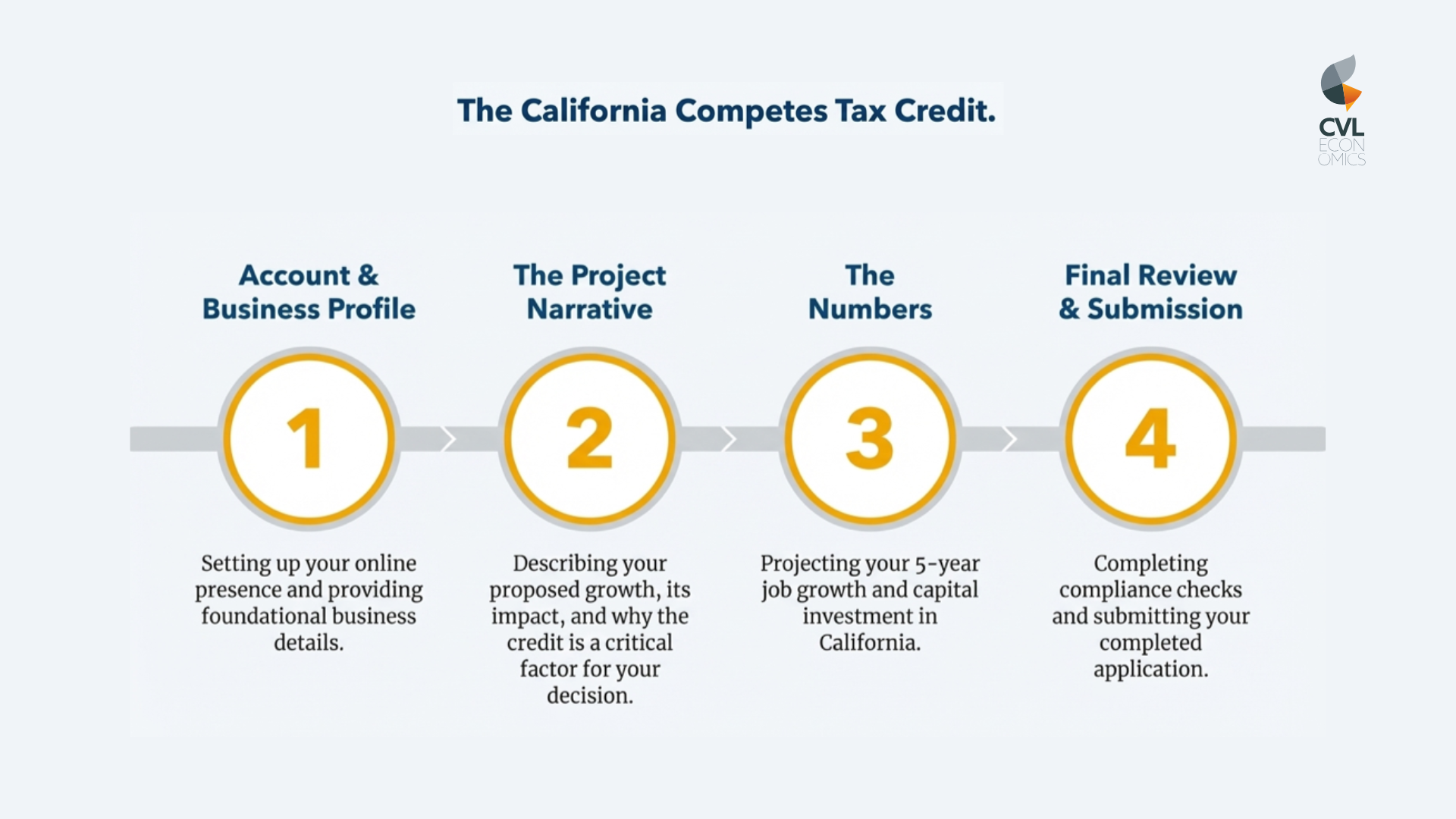

The application window for the current funding period opens January 5, 2026 and closes January 26, 2026. GO-Biz will host informational webinars on January 7 and January 15 to walk prospective applicants through program requirements, evaluation criteria, and application mechanics. The minimum credit request is $20,000, and all credits are tied to the creation of full-time, W-2 employment positions.

For creative economy businesses considering California expansion, relocation, or workforce growth, the CCTC offers a substantial financial tool. Success, however, requires strategic preparation. Applicants must quantify their economic impact, articulate a persuasive "but for" narrative, and demonstrate alignment with the state's broader economic development objectives.

RELATED CONTENT