New IRC Section 181 changes offer immediate deductions for recording costs, promising to reshape local music economies and artist development across the United States.

It has been the spring of tax incentive talk around the U.S. and more specifically in California. As global jurisdictions have ramped up their support of film, television, gaming and theater, states have tried to level the playing field.

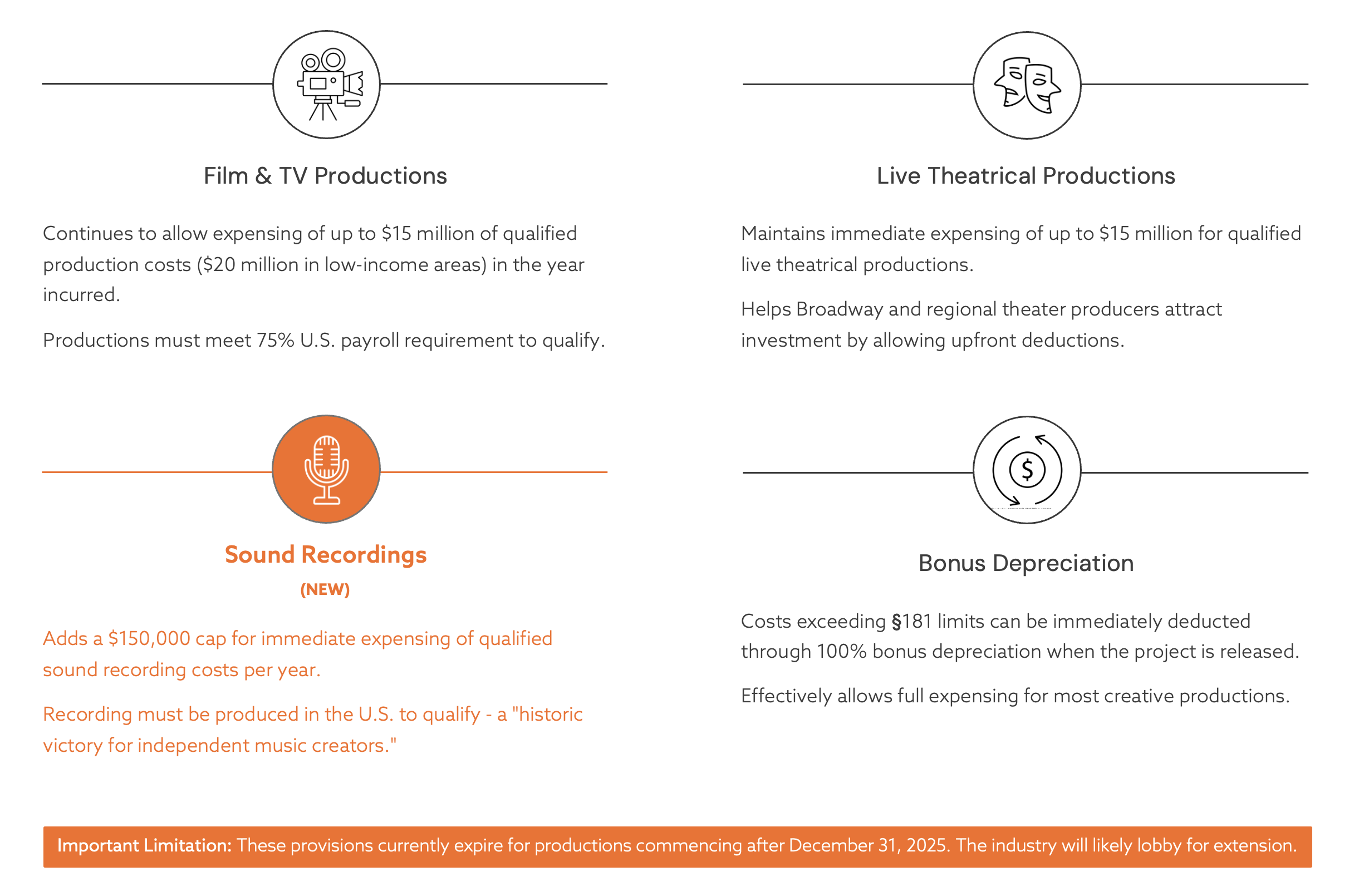

Unlike in other countries, the federal government doesn't have a national film commission or industry support (such as the Department for Culture, Media and Sport in the U.K). One of the tools we do have at the national level is Internal Revenue Code (IRC) Section 181. IRC Section 181 allows film, television, and live theatrical production companies to deduct some qualified production costs in the year those expenses are incurred, rather than capitalizing and amortizing them over several years. This accelerated tax deduction is designed to encourage domestic production and investment in the entertainment sector by reducing upfront tax liability for producers and investors.

Notably missing in this industry mix was music production. That has changed with the passage of the One Big Beautiful Bill (OBBB) Act, H.R. 1, 119th Cong. (2025). The OBBB Act offers independent musicians the same relief that film, TV, and theater producers have had access to for over two decades with the hope that indie labels, studio owners, and self-funded musicians will find it a bit easier to invest in new recordings.

Key Changes Under the One Big Beautiful Bill Act, H.R. 1 (2025)

The landmark expansion of IRC Section 181 now includes "qualified sound recording productions" for the first time, allowing music creators to immediately deduct up to $150,000 in recording costs per year. Under the new law, any sound recording produced and recorded in the United States qualifies for this immediate expense deduction, fundamentally changing the economics of independent music production. Previously, artists and labels were forced to capitalize recording costs and amortize them over the useful life of the sound recording—a complex process that could span several years and provided no immediate cash flow relief.

The mechanics of IRC Section 181 are straightforward but powerful: an independent artist spending $100,000 to record an album in 2025 can write off that entire amount on their tax return in the same year, rather than spreading the deduction across multiple years. For costs exceeding the $150,000 cap, the legislation provides additional relief through coordinated 100% bonus depreciation rules, meaning larger projects can still achieve full immediate expensing when the album is released. This dual mechanism effectively allows most music projects, from bedroom recordings to major label releases, to recover their production investments through immediate tax benefits.

There has been a notable shift in recent years across creative fields, such as journalists, gamers, writers, filmmakers, and influencers towards independent creators. Musicians are no different. Recent estimates place the independent music sector as generating $14.3 billion in global revenue annually, accounting for nearly half of the global recorded music market. Independent music includes everything from self releasing solo artists to more than 13,000 independent labels. The sector continues to experience strong growth and now holds a substantial share of the mainstream market.

However, it is also true that independent musicians are constantly struggling with higher costs and increased competition. CVL Economics’ recent engagement with the Washington Nightlife Music Association has borne out this reality across the west coast where inflation drove costs up considerably for musicians—especially solo musicians— between 2019 and 2023. Indeed, the U.S. Bureau of Economic Analysis' regional price parities put the cost of living in cities like Los Angeles (+15%), Seattle (+13%), and Portland (+7%) above the national average.

The economic implications extend far beyond individual artist tax savings. Music production ecosystems in cities like Nashville, Los Angeles, New York, and Austin should see increased demand for recording studios, session musicians, audio engineers, and supporting services. When an independent artist can recover 21% to 37% of their recording costs through immediate tax deductions, projects that were previously financially marginal become viable. This multiplier effect ripples through local economies, supporting everything from equipment rental companies to late-night food establishments that serve the recording community.

For municipalities, the changes promise increased local tax revenue and economic activity. Recording sessions generate lodging taxes when out-of-town artists visit, sales taxes on equipment purchases, and income taxes on wages paid to local session players and technical staff. Cities with established music districts, from Nashville's Music Row to Los Angeles’ Sunset Boulevard in Hollywood, stand to benefit from increased recording activity as the federal tax code now actively incentivizes domestic music production.

The quality-of-life implications are equally significant. Independent music often reflects local cultural identity and community narratives in ways that major label productions cannot. By reducing the financial barriers to recording, the new deductions support cultural diversity and artistic expression at the grassroots level. Local music scenes—the foundation of nighttime economies that drive tourism, restaurant traffic, and urban vitality—depend on a steady flow of new recordings to maintain their cultural relevance and economic momentum.

However, timing is critical. The legislation includes a sunset provision requiring productions to commence before January 1, 2026, unless Congress extends the program. This creates urgency for artists and industry stakeholders to capitalize on the new incentives while building momentum for a long-term or permanent extension.

The update to IRC Section 181 lends a helping hand to film, TV, live entertainment, and music—industries hit hard in recent years by the pandemic and global competition. The changes promise increased domestic production, leveling of the tax playing field for music, and continued support for film and stage content made in America. For independent music creators who have long watched their film and television counterparts benefit from federal production incentives, this legislative change represents both economic opportunity and long-overdue recognition of music's vital role in America's creative economy.

RELATED CONTENT