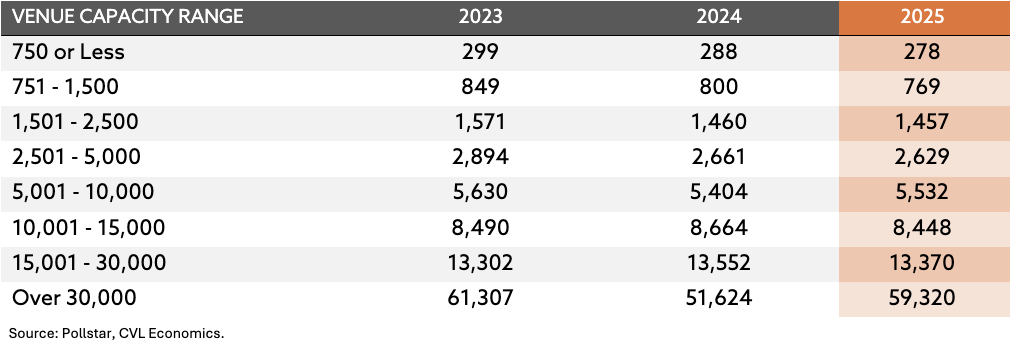

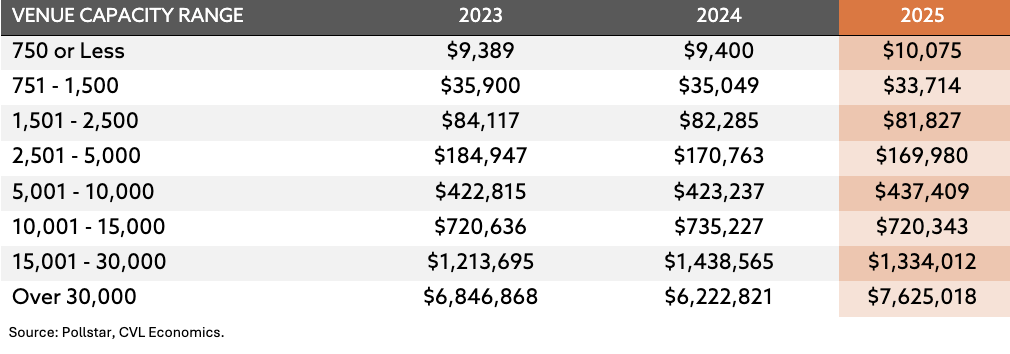

Recent data across venue sizes shows uneven performance across live-music market: premium stadium nights keep smashing records, midsize theaters are emerging as the dependable “workhorse” for cities and developers, and the smallest clubs are tightening their belts. For CVL Economics’ clients in arts & culture and nighttime economies, the takeaway is strategic—not just celebratory. Treat venues like essential infrastructure and protect the small-venue ladder that feeds tomorrow’s headliners.

Start at the top. Stadium-scale concerts continue to run hot, with average tickets, grosses, and prices all up versus the prior year. Industry trackers point to ticket counts above 59,000 per show for the largest spaces, an average gross exceeding $7.6 million, and a sharp step-up in prices— momentum powered by global stars who can unlock premium willingness-to-pay. That heat at the top distorts consumer behavior downstream: many fans are consolidating spend into a few marquee nights rather than multiple small outings. If you’re a city or district operator, that means planning your nighttime economy around fewer, bigger peaks, and designing streets, transit, and hospitality to capture and manage those surges.

Average Tickets Sold by Venue Size | 2023 - 2025

Average Gross Receipts by Venue Size | 2023 - 2025

The most actionable growth lane, however, sits just below the mega-tier. Developers and operators are zeroing in on 3,000–6,000-seat venues, large enough for immersive production values, small enough to book consistently and feel personal. Live Nation’s CEO calls 6,000 seats “a new sweet spot in music,” a scale that artists choose when they can’t quite fill a 15,000-seat arena but want to deliver a premium show. Cities are building around this insight: a 6,000-seat capacity theater now anchors a new entertainment district in downtown Salt Lake City (roughly 200 events annually inside a $1.8B mixed-use plan), with similar midsize projects from Anaheim’s OCVibe (5,700 seats) to Atlanta’s Centennial Yards (5,300 seats). This is exactly what we mean by treating venues as infrastructure for an experience economy: a reliable bookings pipeline that keeps district restaurants, hotels, and late-night retail busy when the arena lights are off.

Operational performance backs up the thesis. In Greater Palm Springs, Acrisure Arena is compressing seven marquee events into 12 days, from Paul McCartney and The Who to an NBA preseason showcase and AHL home opener, demonstrating how fast turns and flexible back-of-house keep a building “hot” and local spending circulating. The same venue ranked No. 66 worldwide on Pollstar’s 2024 year-end grosses at $39.62M, evidence that secondary-market arenas with agile programming can punch above their weight.

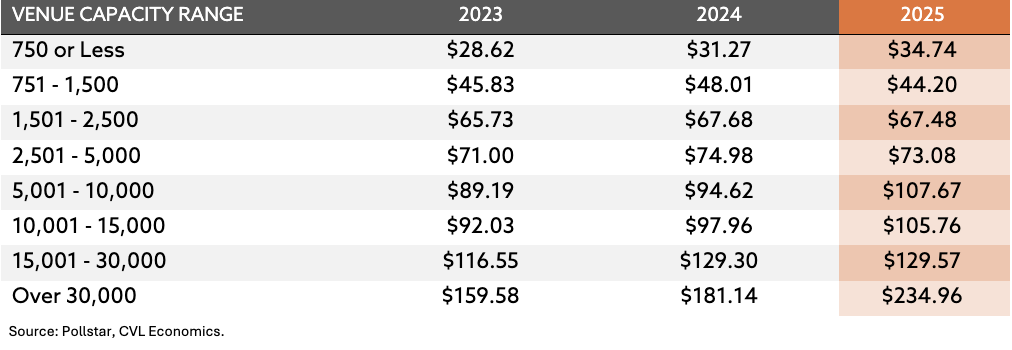

Yet the market’s other end is flashing yellow. Clubs under 750 capacity posted rising average gross but fewer tickets sold, a combination that hints at affordability stress for audiences and thinner margins for operators. Venues in the 751 to 1,500 seat range show a 3.9% slide in tickets and a similar drop in gross versus recent years—again, not catastrophic, but telling for a segment that often operates with limited reserves. The 1,501 to 2,500 seat tier looks steadier on volume, but price is doing more of the work, with average tickets essentially flat and double-digit gains in average price.

Average Ticket Price by Venue Size | 2023 - 2025

These dynamics matter for policy. The smallest rooms are development infrastructure for the creative economy where artists build audiences, neighborhood nightlife gains depth, and local talent ladders up to midsize and arena stages. When these venues struggle, the whole pipeline shrinks. Cities and counties that want durable arts and nighttime economies should make it easier and cheaper to operate small venues: aligning permitting and inspections to late-night hours, streamlining sound mitigation approvals, and piloting micro-grants or shared-security programs that reduce fixed costs without compromising safety. That’s the “protect the small-venue ladder” mindset in practice, not rhetoric.

For owners, operators, and developers, the investment case is equally clear:

Safeguard neighborhood stages. The under 750-seat and 750- to 1,500-seat segment is where affordability stress and margin pressure show up most clearly. Cities and developers should stabilize this tier with streamlined permitting, shared-security or insurance pools, and micro-grants that reduce fixed costs. For operators, this scale is the training ground where artists build audiences and scenes gain depth; investing here protects the pipeline that fills tomorrow’s midsize theaters and arenas

Design mixed-use districts around midsize music real estate. As one industry leader put it, “Live is on fire. Venues have become the new movie theater.” Co-locate 3,000 to 6,000-seat rooms with hospitality and retail to extend activity beyond game days and make ingress/egress and rideshare zones part of the site plan from Day One.

Engineer multipurpose agility into the back-of-house. Acrisure’s 12-day run illustrates how swiftly toggling from concerts to basketball to hockey protects utilization and smooths revenue. Build for same-week reconfigurations and tiered premium offerings so your venue can monetize superfans across formats.

Price strategy = place strategy. With headline tours pushing global grosses to $9.5B and average top-tour prices near $136 per ticket, consumers are trading up to fewer premium nights out. District plans should anticipate bigger single-night checks (and bigger crowds) with dining capacity, crowd management, and transit coordination calibrated to pre/post-show peaks.

Finally, don’t lose sight of balance. Stadiums capture headlines and tax receipts; midsize theaters anchor year-round activity; and small venues cultivate the next wave of talent and keep neighborhood nightlife vibrant. The healthiest city strategies connect all three: incentivize right-sized new builds in mixed-use districts and stabilize the grassroots stages that make a scene worth visiting in the first place.

At CVL Economics, we help public agencies, developers, and venue operators translate audience demand into investable venue strategies, quantifying how capacity, pricing, and programming shape district vitality. As recent data makes clear, the growth engine is real, but it’s not automatic. Treat venues as infrastructure, and protect the small-venue ladder, and your nighttime economy won’t just ride this cycle—it will build resilience for the next one.

RELATED CONTENT